Mutual funds are becoming a very popular word. Today everyone is talking about mutual funds, you must have also heard about mutual funds. If you have not heard about it, then it is okay, and if you have heard about it and you want to know and understand it well, then you are on the right page. Let’s understand “The Mutual Funds”.

Let’s understand by its name first, mutual fund is made up of two words – Mutual + Funds.

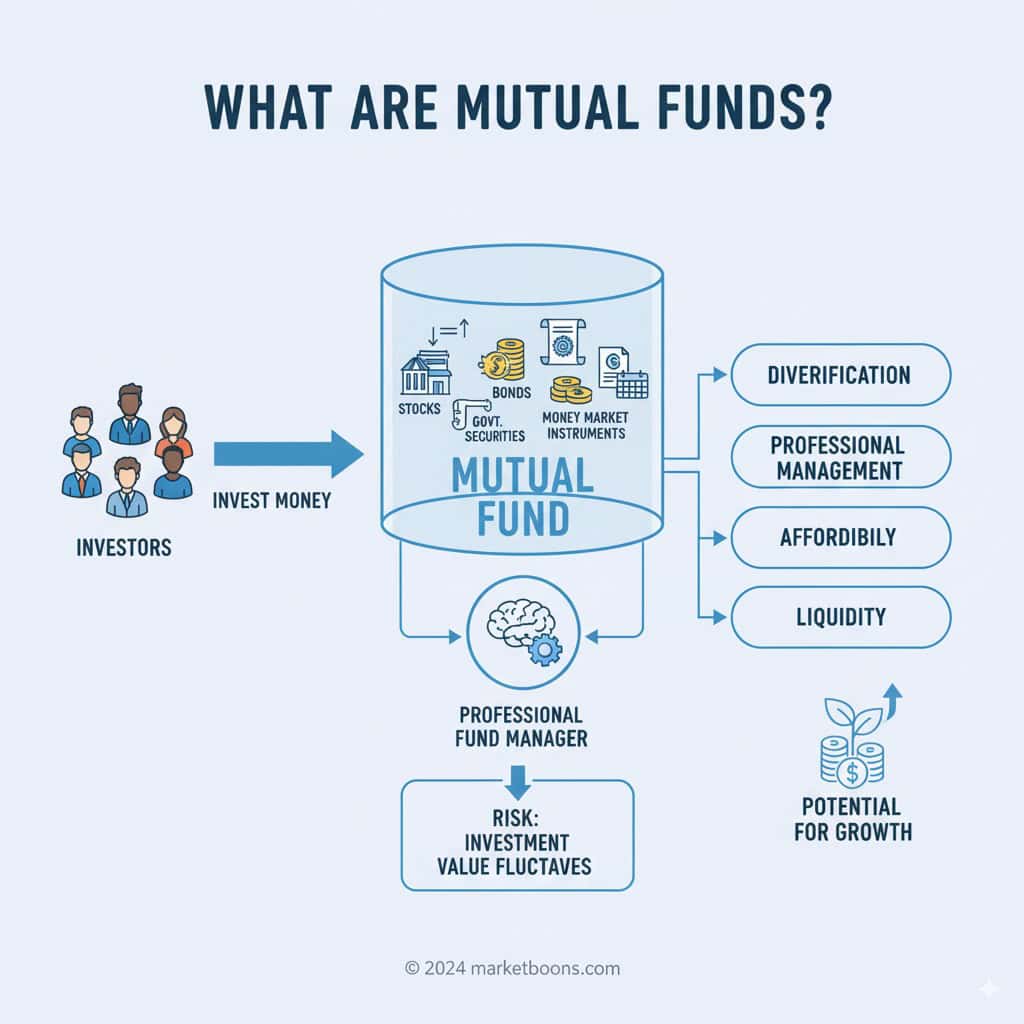

Mutual Funds are funds that collect money from a number of investors, diversify the money into different securities, reduce the risk of investors, generate a better return & distribute the returns to the investors.

Before understanding how a mutual fund works, we should know about the ‘Asset Management Company’, which is the creator and manager of these mutual funds-

Asset Management Company ( AMC) or Mutual Fund Company or The Creator and Manager of the Mutual Funds:-

As we understand what mutual funds are, a question must have come to mind: Who is behind the mutual funds? Who is creating these funds? Who is managing it?

So the answer is The ‘AMC’, Asset Management Company – The Brain behind the Mutual Funds – the creator and manager of these mutual funds.

Please find all the AMCs and their official websites here at one place, you can can also search the AMCs with their name.

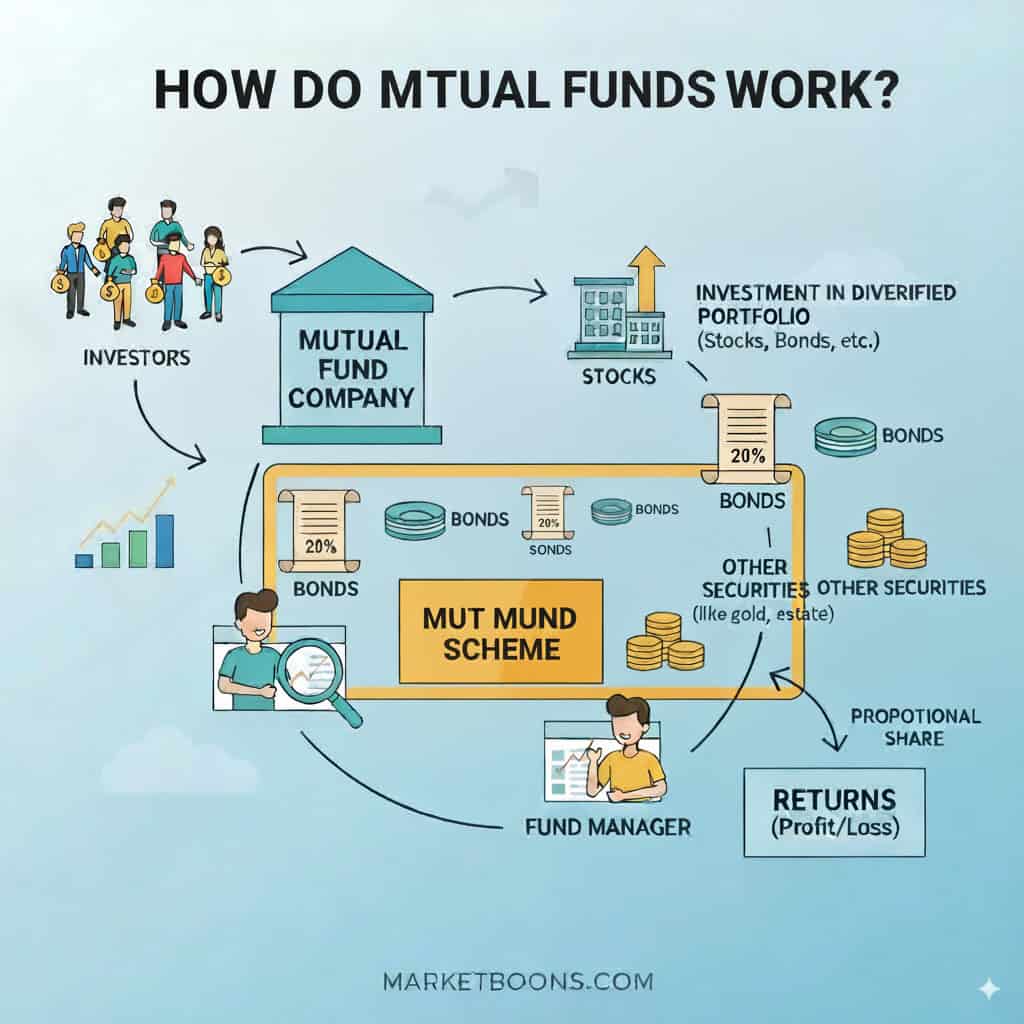

How Mutual Funds work ?

Mutual funds often feel confusing because of words like NAV, diversification, or expense ratio. So don’t worry! and don’t be confused also, let’s understand how this mutual fund works with a very simple and relatable example :

If we imagine a ‘Mutual Fund Scheme’ is a ‘Box’ ( Mutual Fund = Box ), everything becomes much easier to understand. Let’s open this box step by step and see how it actually works.

1st. Mutual Fund Scheme = A ‘Box‘ Designed by AMC

As per investor’s need and their investment purpose, An AMC (Asset Management Company) is like a manufacturer that creates many different boxes, each designed for a specific type of investor. Some boxes are built for safety, some for growth, and some for balanced returns.

For example:

- A box filled mostly with stocks/Equity Shares is meant for long-term growth. = Equity Mutual Funds ( Equity Growth Box )

- A box filled with bonds or debt is for safer, steady returns. = Debt Mutual Funds ( Debt Safety Box )

- A box with both stocks and bonds is for balanced investors. = Hybrid Mutual Funds ( Hybrid Box )

So, the AMC designs the box carefully, keeping in mind the needs of different investors.

2nd. On this ‘Box’ ( Mutual Fund ), Everything Has Been Written Clearly

Like every product you buy in a shop, this investment box also comes with a ‘label’, Box Label explains everything clearly as:

- What the box is –

- Equity fund

- Debt fund

- Hybrid fund

- Purpose

- Growth,

- Regular income,

- Or both

- Where your money will go – types of securities

- Company’s Shares

- Bonds

- Government Securities

- Money Market Instruments Etc.

- Who manages it

- The Fund Manager ( A professional, well educated and experienced person in financial markets )

- Charges

- expense ratio

- exit load

- Past performance – If the box is not new

- Past One Year, 3 Years , 5 Years & All time returns.

- Past return per year like – 12% , 15% , 20% and more

- Lock -in Period – Nil/0 , 3 Years , 5 Years

This ‘label’ is like the mutual fund factsheet. It tells you everything before you decide to put money inside.

3rd. You Put Money In The Box ( Invest in Mutual Fund ) and Get Units

When you like the box, you put your money inside. In return, you get units.

Each unit has a price called NAV (Net Asset Value). NAV is simply the value of everything inside the box divided by the number of units.

👉 Example:

- NAV today = ₹10

- You invest ₹1,000

- Units you receive = ₹1,000 ÷ 10 = 100 units

Now, you own part of that mutual fund box.

4th. Fund Manager Invests The Box Money ( Diversification Starts to Reduce ‘Risk’ )

Once the money enters the box, the fund manager starts investing it. Depending on the scheme,

the manager may buy:-

- Shares of different companies

- Government or corporate bonds

- Gold or other assets

- Money Market Instruments Etc.

This process is called diversification. Instead of you putting all money at one place, the fund manager spreads it across different financial securities and assets to reduce risk.

5th. Value Of The ‘Box’ Changes Everyday

The value of the ‘Box’ depends on the performance of the Investment Holdings ( diversified securities , holding companies, bonds and assets )

- If Holding Companies performing well the share price goes up, then the box’s value increases.

- If Holding Companies not performing well the share price goes down, then the box’s value decreases.

Or we can say if Market goes up the Box value goes up , if Market goes down the Box value goes down.

This directly affects the NAV—the price of your units. When the value of the box increases, the NAV goes up. When the value falls, NAV goes down.

6th. When NAV Rises Your Units Gain Value

Remember, you received some units when you invested. The number of units remains the same, but their value changes with the NAV.

👉 Example:

- You bought 100 units at ₹10 = ₹1,000 invested.

- After some time, NAV rises to ₹12.

- Value of your investment = 100 × ₹12 = ₹1,200.

You earned ₹200 profit (before charges and taxes). If NAV goes down, your value reduces.

If you want to calculate how much wealth you can generate by investing in Mutual Funds, Please try our Market Boons SIP Calculator https://marketboons.com/sip-calculator/

7th. AMC Deducts Charges

Running a mutual fund involves cost—research, experts, systems. For this, the AMC charges a small fee called expense ratio.

- Deducted automatically from the NAV.

- You don’t pay it separately, but it reduces returns slightly.

Some schemes may also have exit load if you withdraw too early.

8th. Taxes, When You Sell Your Units

When you redeem (sell) your units and take money out, the government may charge taxes on your profit.

The tax depends on two things:

- Based on fund type

- Equity

- Debt

- Based on holding period

- Short-Term ( Less than one year ) STCG

- Long-Term ( More than one year) LTCG

👉 Example:

If you invested ₹1,000 and sold for ₹1,200, your profit is ₹200. Tax is charged only on the profit, not on the entire ₹1,200.

9th. The Final Return – For, You Have Put Your Savings In The ‘Box’

When you withdraw or redeem your mutual fund’s units the amount will be credit directly into your bank account.

The Redemption Value = (Units × NAV at selling) – Charges

This is the profit before tax, credited to your bank account. After that you have to pay the taxes to the government according to your profits.

The Actual Profit = (Units × NAV at selling) – Charges – Taxes

The Actual Profit = Actual Return On Investment

Quick Recap – Mutual Fund as a ‘Box’

- AMC designs the box for investors.

- Everything Mentioned on the Box = Label shows purpose, risks, and charges.

- You invest and get units.

- Fund manager invests in different assets.

- Box value changes with market performance.

- NAV rises → your units gain value.

- AMC deducts fees.

- Taxes apply on profit.

- You finally receive your returns.

Note: Numbers are illustrative; actual amounts depend on exact expense ratio, holding period, fund type and prevailing tax laws.

You can check latest NAV of all the Mutual Funds on AMFI ( Association of Mutual Funds in India ) https://www.amfiindia.com/investor-corner/knowledge-center/net-asset-value.html?utm_source=chatgpt.com